-Durga Prasad Gautam

For many nations, including Nepal, foreign direct investment (FDI) is a major source of financing. FDI makes it easier to transfer financial resources, technology, and other intangible assets like managerial expertise. and administrative abilities, as well as access to international markets, which enable to increase the host economy’s output and productivity.

According to the OECD (2008), direct investment is a category of cross-border investment where a resident of one economy (direct investor) controls or significantly influences the management of a business (direct investment enterprises) that is located in a different economy than the direct investor.

In recent years, Nepal has started institutional and legal reforms with the goal of encouraging FDI to fill the resource deficit in capital formation. By fostering a climate that is friendly to investment and giving reforms relating to foreign investment priority, gradual liberalization of FDI inflows in a number of industries has been fostered.

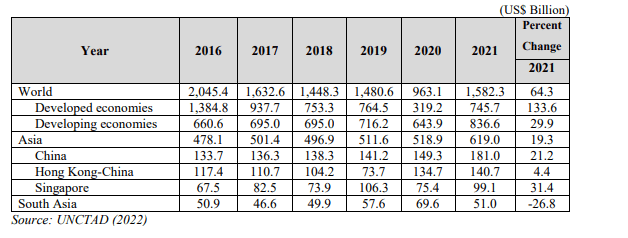

According to UNCTAD’s World Investment Report 2022, worldwide FDI inflow surged by 64.3 percent to USD 1,582.3 billion in 2021 from USD 963.1 billion in 2020. Global FDI inflows have significantly recovered as a result of booming merger and acquisition (M&A) markets and quick expansion in international project finance.

FDI in developed economies climbed from USD 319.2 billion in 2020 to USD 745.7 billion in 2021, a 133.6 percent rise. From USD 643.9 billion in 2020 to USD 836.6 billion in 2021, inflows to developing economies grew by 29.9% (UNCTAD, 2022).

FDI Inflows by Economy and Region

Asia receives 40% of all FDI worldwide, making it the largest receiving area (UNCTAD, 2022). From USD 518.9 billion in 2020 to USD 619.0 billion in 2021, FDI in this region surged by 19.3%. The top recipients of the inflows are still China (USD 181.0 billion), Hong Kong (USD 140.7 billion), and Singapore (USD 99.1 billion).

FDI inflows to South Asia fell by 26.8% in 2021, to $51.0 billion.The largest FDI recipient in the sub-region, India, saw a fall in FDI of 30.2% with inflows of USD 44.7 billion in 2021.

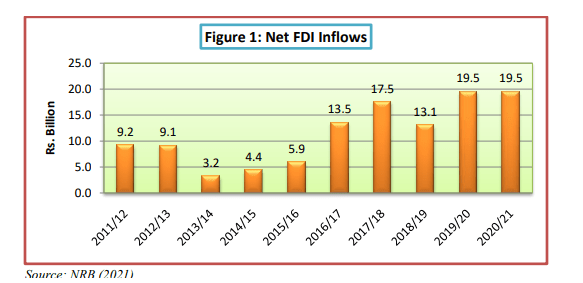

Inflows of gross foreign direct investment rose 1.2 percent to Rs. 19.9 billion in 2020–21. The repatriation of investments (divestment of foreign investment) amounted to Rs. 396.7 million in 2020–21, or around 2.0% of total FDI inflows (NRB, 2022).

Inflows of net foreign direct investment into Nepal rose by 0.2% to Rs.19.5 billion in 2020–21

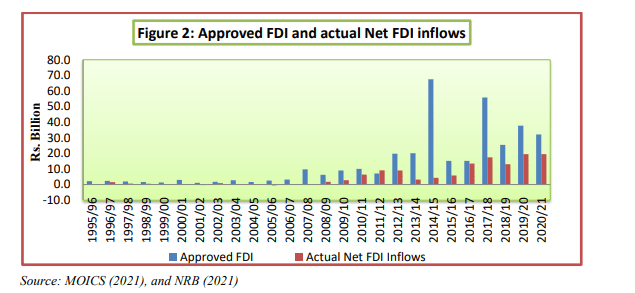

According to the most current FDI realization trend (Figure 2), there is a significant discrepancy between permitted FDI and actual net FDI inflows in Nepal.

There may be a large time lag between FDI approvals and real investments, or the FDI permission may suggest an expected investment that doesn’t actually materialize. The realization of the approved investment may occasionally take place across a number of years, as is typical for projects with longer gestation periods. As a result, there is a discrepancy between FDI approval and FDI inflows.

An sanction worth Rs. 26.1 billion was given for dividend repatriation by enterprises having foreign investment in 2020–21. The industrial sector was followed by the information and communication industry in terms of approved dividend repatriation.

As of mid-July 2021, the stock of FDI in Nepal has grown by 14.8 percent throughout the course of 2020–21 (Table 4). Loans rose by 41.5 percent; reserves rose by 7.3 percent; and paid-up capital rose by 13.7%. As of the middle of July 2021, Nepal’s foreign direct investment liabilities was Rs. 227.9 billion.

(Principal at Arya Academy High School Subhakamana Tole , Nagarjun -4, KTM) (durga.gautam@pac.tu.edu.np)